Regretably, if you have a small credit rating score, it could be tough to locate a lender that’s willing to work along with you. Within the eyes of lenders, the lower your credit score rating, the riskier you might be to be a borrower. Lenders use credit scores To guage how likely you will be to repay your loan.

Based on the lender or institution, the application and approval system for personal loans is often quick and you'll get the money disbursed in the lump sum amount of money in just one to 2 business enterprise times.

On the internet lenders offer versatility to buyers who don’t want to become a credit score union member or financial institution purchaser.

Mortgage loan desire costs as well as other expenditures differ considerably from lender to lender. You may Look at present fascination prices speedily by making use of a System like Credible. The website supplies offers from thirteen various property loan providers so that you can check for the ideal mortgage rates.

Kim copyright is actually a guide assigning editor on NerdWallet's loans staff. She addresses buyer borrowing, which include subject areas like particular loans, acquire now, pay out later on and hard cash advance applications. She joined NerdWallet in 2016 after 15 yrs at MSN.com, where she held various articles roles including editor-in-Main in the overall health and foods sections.

Savings account guideBest financial savings accountsBest large-yield savings accountsSavings accounts alternativesSavings calculator

A lot of lenders assign a loan coordinator to guide you through the entire process of publishing your paperwork.

The compensation we acquire from advertisers isn't going to influence the suggestions or advice our editorial staff gives inside our articles or blog posts or or else impression any in the editorial written content on Forbes Advisor. Although we work flat out to provide exact and up to date information that we predict you'll find suitable, Forbes Advisor doesn't and cannot promise that any information presented is entire and tends to make no representations or warranties in link thereto, nor to your precision or applicability thereof. Here's a listing of our associates who offer products that We've got affiliate inbound links for.

In the event you’re new to this submitting approach, check out to obtain your credentials—secured username and password. Make sure that it’s the individual authorized to finish the form who signs up for your business.

Lots of lenders have to have personal savings of at the very least two to thrice your regular mortgage loan amount in reserve to finish the underwriting procedure.

Accessibility: Lenders are ranked greater more info if their private loans can be found to more people and demand fewer situations. This will likely include things like decreased credit rating necessities, wider geographic availability, more rapidly funding and less complicated and a lot more transparent prequalification and software procedures.

The upper your credit history rating, the decreased your fascination premiums. Remember the fact that the bottom fascination costs advertised on lender Internet sites might not be available to you. To see what fascination premiums you can obtain, reap the benefits of lenders' pre-qualification characteristics, if obtainable. Pre-qualification permits you to input essential facts about by yourself and your desired loan in Trade for any snapshot from the fees and phrases supplied.

Businesses typically answer that specific options do not have individuals, commonly given that they are new applications. Nevertheless, according to Variety 5500 Guidance, every eligible worker with prepare balances is termed a approach participant.

For anyone who is struggling to repay the loan, the lender can confiscate the collateral to recoup their losses. Using a secured loan, having said that, interest costs are frequently reduced. This can be a fantastic option for borrowers with reduce credit score scores that have valuable collateral to offer and so are absolutely sure they can repay their loan.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Ashley Johnson Then & Now!

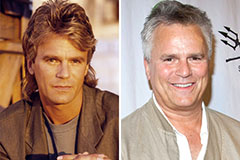

Ashley Johnson Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!